In the latest acknowledgment by a media titan that sinking linear television is holding back overall growth, Warner Bros Discovery (WBD) has ann

In the latest acknowledgment by a media titan that sinking linear television is holding back overall growth, Warner Bros Discovery (WBD) has announced a fresh corporate structure to separate its linear and streaming & studios businesses.

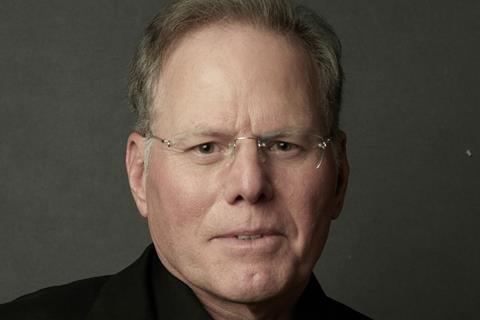

Global Linear Networks and Streaming & Studios will operate as two distinct units within WBD, which CEO David Zaslav said would drive free cash flow at the former, and enable growth at the latter.

Wall Street responded positively as shares leapt more than 15% in early trading on Thursday to around $12.50, its highest point in 2024, which has now seen a 7.3% year-to-date gain.

The fresh structure is expected to be implemented by mid-2025 and comes as media analysts have openly spoken about the merits of a split at WBD to divest itself of the financial burden of linear, which has seen advertising revenue drop amid the rise of streaming and social media spend and subscriber growth. In April WBD took a $9.1bn write-down as it acknowledged the sinking value of its cable business.

Last month Comcast said it was spinning off the bulk of its cable assets into a stand-alone publicly traded company, a move that is expected to close next year.

WBD’s proposed Global Linear Networks division will operate the news, sports, scripted and unscripted programming networks including CNN and the Food Network, while Streaming & Studios will contain Warner Bros film and television studios, and Max.

The company said it anticipated the fresh corporate structure would “enhance clarity and focus” and “increase optionality to pursue further value creation opportunities for both divisions in an evolving media landscape”. The company added that it expected “to continue to evolve the board to execute its strategy and drive future shareholder value creation”.

In a statement Zaslav said, “Our new corporate structure better aligns our organisation and enhances our flexibility with potential future strategic opportunities across an evolving media landscape, help [sic] us build on our momentum and create opportunities as we evaluate all avenues to deliver significant shareholder value.”

J.P. Morgan, Evercore, and Guggenheim Securities are serving as financial advisors to WBD and Kirkland & Ellis and Wachtell Lipton are serving as legal counsel.

COMMENTS