Warner Bros Discovery (WBD) has put itself up for sale after announcing that it has received “unsolicited interest” for both the entire company a

Warner Bros Discovery (WBD) has put itself up for sale after announcing that it has received “unsolicited interest” for both the entire company and its standalone studio and streaming business Warner Bros.

In a press release, WBD said its board had “initiated a review of strategic alternatives to maximize shareholder value”.

Currently, the company is continuing with its plan to separate into two separate companies, splitting its studios and streaming business from its legacy television networks.

Earlier this month, it was reported that Paramount CEO and chairman David Ellison had made a bid for WBD that was rebuffed.

WBD said: “Through this process, the Warner Bros. Discovery Board will evaluate a broad range of strategic options, which will include continuing to advance the Company’s planned separation to completion by mid-2026, a transaction for the entire company, or separate transactions for its Warner Bros. and/or Discovery Global businesses. As part of the review, the Company will also consider an alternative separation structure that would enable a merger of Warner Bros. and spin-off of Discovery Global to our shareholders.”

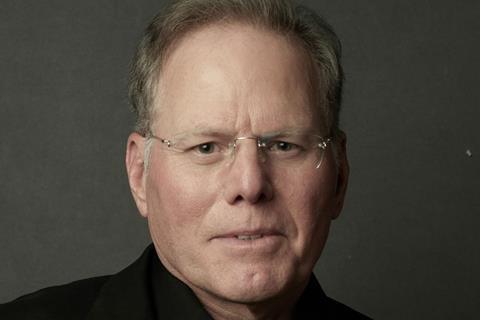

WBD president and CEO David Zaslav said: “It’s no surprise that the significant value of our portfolio is receiving increased recognition by others in the market. After receiving interest from multiple parties, we have initiated a comprehensive review of strategic alternatives to identify the best path forward to unlock the full value of our assets.”

The company added that there is no “deadline or definitive timetable set for completion of the strategic alternatives review process” and that there is “no assurance that this process will result in the Company pursuing a transaction”.

COMMENTS