BFI deputy CEO Harriet Finney said she is very optimistic that the Independent Film Tax Credit (IFTC) will be ratified under the new UK government.

BFI deputy CEO Harriet Finney said she is very optimistic that the Independent Film Tax Credit (IFTC) will be ratified under the new UK government. The IFTC, an enhanced tax relief of 40% for films budgeted under £15m, was announced under the last Conservative government and went through into the Finance Act in May.

Finney, speaking at Screen’s ‘The Future of UK Film’ Summit, said the Department for Culture, Media and Sport (DCMS) is working hard on everything that needs to happen in terms of getting the statutory instrument laid. Since the surprise July general election, a new Labour government has come into power.

"There have been very very small windows where the government has been able to do any legislation," Finney said. "The last thing that needs to happen to bring this into force, to [be able to] issue certificates and finances, is [the government] needs to lay a statutory instrument, and that is what will set out all the detail which is sits behind the proposal. It will set out the guidance and what people need to do."

Finney reassured that the BFI is ready to deal with the anticipated rise in certification submissions once the IFTC is ready to be implemented. The BFI has done a lot of work in terms of making sure that its certification unit is fully staffed, and has brought on five new staff to help deal with the anticipated demand.

Moses Nyachae, partner in the film and TV team at chartered accountants Saffery, echoed Finney’s confidence, saying that there are no indications otherwise, and that the IFTC is received royal assent and is in the act. The main question he is receiving from producers is if the IFTC is still going ahead, and he confirmed that there is no cap on the number of productions that can use the incentive.

Producer Nicky Bentham, who has been a key advocate for the IFTC, said that the industry has reached a crisis point, with producers struggling to secure budgets, get films into production, and make a living. She added that the IFTC will be transformative for indie filmmakers, and has already encouraged her to restructure a project to shoot in the UK.

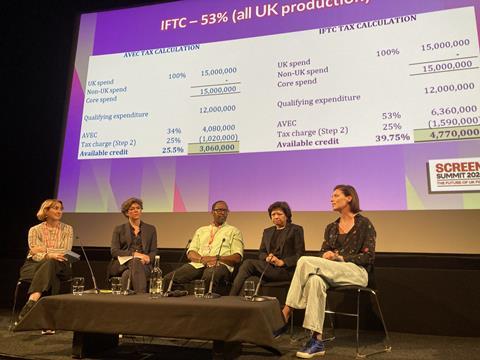

"If a film’s budget when in production subsequently exceeds £15m, the production company can choose either to continue to claim IFTC at 53% up to a maximum of £6.36m credit before tax, or choose instead to claim AVEC at 34% on all its qualifying expenditure," Finney explained.

To qualify for IFTC, films need to meet the BFI’s existing cultural test for a UK film and additionally have a UK writer, UK director, or be an official co-production, and intended for theatrical release. Eligible films will be able to opt-in to claim the enhanced Audio-Visual Expenditure Credit (AVEC) at a rate of 53% on up to 80% of core expenditure, which equates to around 40% in relief.

Producers: Plight or Fight?

The state of the independent film sector is abysmal, said Gillian Berrie of Sigma Films. There has to be government intervention at this point, she added. Fiona Lamptey, former director of UK features at Netflix, noted that Juno Studios is exploring non-traditional avenues of funding and looking at fan-funded entertainment.

Conclusion

The IFTC is a vital incentive for the UK independent film sector, and producers are eagerly awaiting its implementation. The BFI and DCMS are working hard to ensure its smooth passage, and producers are confident that it will bring much-needed relief to the sector.

FAQs

- What is the Independent Film Tax Credit (IFTC)?

The IFTC is an enhanced tax relief of 40% for films budgeted under £15m. - When will the IFTC be implemented?

The IFTC is expected to be implemented once the statutory instrument is laid. - How will the IFTC work?

Films will be able to opt-in to claim the enhanced Audio-Visual Expenditure Credit (AVEC) at a rate of 53% on up to 80% of core expenditure, which equates to around 40% in relief. - Who is eligible for the IFTC?

Films must meet the BFI’s existing cultural test for a UK film and additionally have a UK writer, UK director, or be an official co-production, and intended for theatrical release.

COMMENTS