Warner Bros Discovery (WBD) top brass have spoken about the impending split that will produce two novel potential acquisition targets and is expe

Warner Bros Discovery (WBD) top brass have spoken about the impending split that will produce two novel potential acquisition targets and is expected to facilitate usher in a period of M&A activity in the US media landscape.

In a call with analysts on Monday, WBD CFO Gunnar Wiedenfels said the separate companies would be “free and clear” for M&A talks with no waiting period once they split off. He confirmed the company is expected to separate into Streaming & Studios and Global Networks by mid-2026, subject to certain conditions and approval from the WBD board. WBD announced the split early on Monday morning.

The impending separation effectively undoes the $43bn merger between WarnerMedia and Discovery in 2022, with the net result that WarnerMedia’s former owner AT&T divested itself of its media holdings.

Monday’s announcement was the latest example of a media company recognising after all that its ailing linear TV business was weighing down its growth areas, in other words, streaming. Like Comcast, which spun off the newly titled Versant cable business, and the Lionsgate-Starz split, the WBD plan means that potential buyers – and observers have suggested Apple may be one of those – will be watching closely.

Since the 2022 merger, WBD’s stock has fallen by about 60%. Following Monday’s announcement of the split, the share price fell by just under 3% after the market closed.

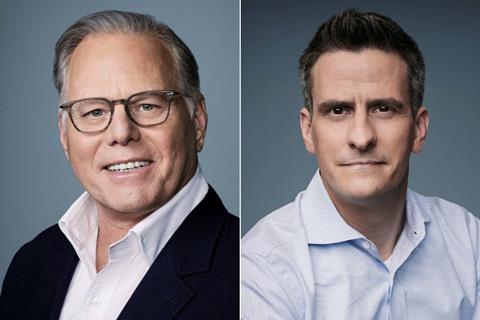

“We believe the benefits of a separation now into two scaled businesses will really give us a lot more strategic flexibility for the future,” said WBD CEO David Zaslav, foreshadowing potential M&A deal-making down the line after a slower than expected period since Donald Trump returned to the White House.

Both Zaslav and Wiedenfels, who will respectively run Streaming & Studios and Global Networks, said they have eliminated about $5bn of “non-content” costs in the last three years. Wiedenfels has has presided over several rounds of layoffs mostly in the cable television business and said both stand-alone companies will “continue to be very focused on efficiency”.

The executive said Global Networks will retain up to a 20% stake in Streaming & Studios to “enhance the deleveraging path for Global Networks”, which observers believe will remain a priority given that Wiedenfels said the linear TV division will assume most of WBD’s debt load that runs into the tens of billions.

For his part, Zaslav made it clear that a key revenue driver at Streaming & Studios will be streaming and noted: “The motion picture business is probably the smallest part; it’s very hit-driven.” Mindful of “underused” IP, Zaslav wants to see motion picture group co-heads Mike De Luca and Pam Abdy “mining those big brands that give us real advantage in the marketplace”. The co-heads weathered a tough start to the year and have bounced back with the theatrical successes of A Minecraft Movie, Sinners, and Final Destination: Bloodlines.

Sticking with the IP theme, Zaslav continued: “We’re very excited about Superman [James Gunn’s reboot opens on July 11]. We’re almost wrapped with Supergirl. There’s a great plan around DC, a 10-year plan. Warner Bros has had three consecutive hits and we’re going to be distributing F1 in the next two weeks [in a partnership with Apple]. We really like the motion picture business. We think it’s critical to have those movies. We also have the A24 movies coming into HBO Max, and we’ve put in real discipline and we have confidence in that business, but it’s probably the more difficult business in terms of margin and swings.”

Zaslav added that “the secret sauce for us is the highest quality content and library, together with local content, together with local sports. And that will be our global recipe”. At another point in the call Zaslav said: “We’ve put ‘HBO’ back in [to HBO Max] for a reason – people see us as the highest quality streaming service out there. We have the highest quality motion picture and TV library, as well as all the HBO content. We have the ability with Warner Bros Television to augment, which we did with The Pitt and we’re doing with Harry Potter.”

The Harry Potter series is scheduled to begin production at Warner Bros Studios Leavesden this summer and WBD announced a raft of casting on Monday. The show is expected to premiere on HBO Max in 2026. Zaslav said the platform will launch in UK & Ireland, Germany, and Italy in early 2026.

Separately, Warner Bros Television Group chairman and CEO Channing Dungey has circulated an internal memo to say she will remain with Streaming & Studios after the split.

COMMENTS